Are you meticulously tracking every penny related to your tax return, and do you understand exactly what constitutes "total payments and withholding" as requested on the "tell us about your refund" page? Understanding this seemingly simple question is absolutely critical to avoiding errors, potential audits, and ensuring you receive the correct tax refund you are entitled to.

Navigating the intricacies of tax filings can often feel like traversing a labyrinth, and the "tell us about your refund" section is no exception. It's a crucial juncture where accuracy is paramount. When prompted to provide the total of your payments and withholding, the IRS is essentially seeking a comprehensive overview of all the money you've already paid towards your tax liability for the year. This includes not only the obvious the taxes withheld from your paychecks but also other forms of payments you might have made throughout the year. Let's delve deeper into what this encompasses and why it's essential to get it right.

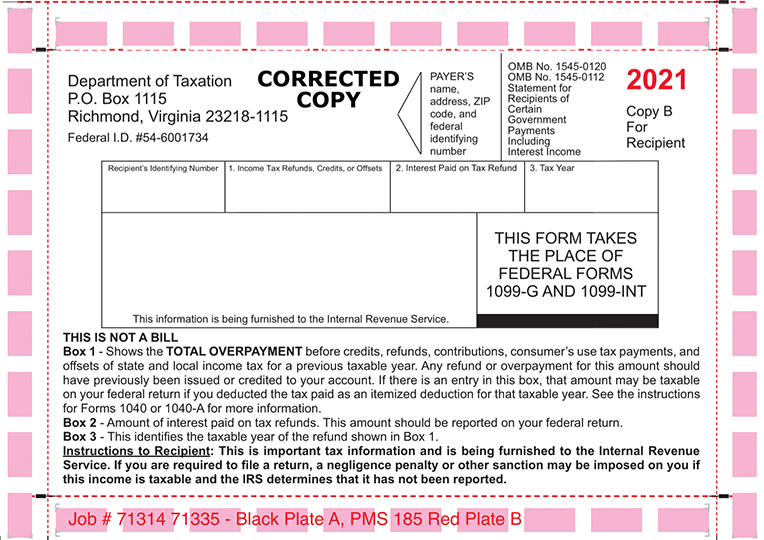

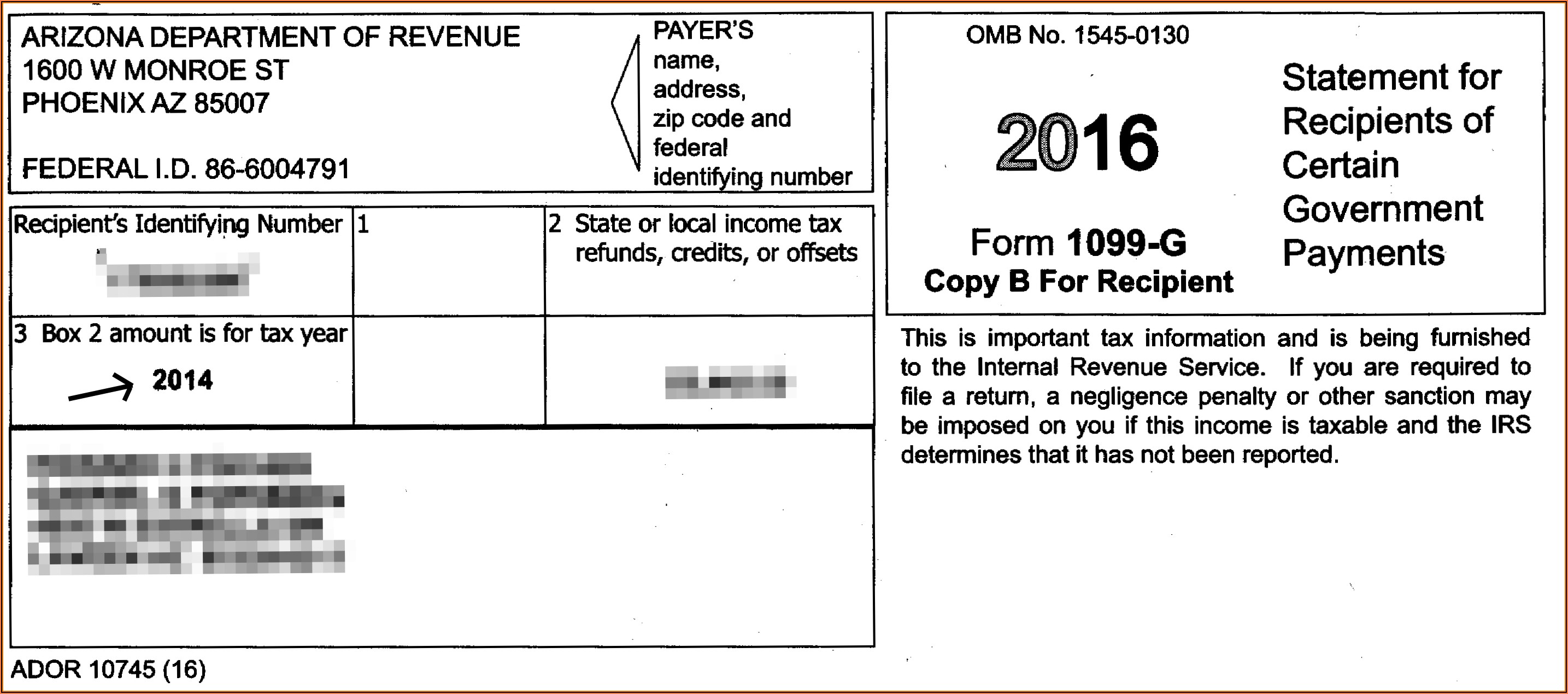

The IRS, under Section 6050E of the Internal Revenue Code, mandates transparency and compliance regarding state or local tax refunds. This is where the 1099-G form comes into play. The 1099-G, "Certain Government Payments," is the form you receive from a state or local government if you received a refund, credit, or offset of state or local income taxes. But what if you are missing it? Missing this document requires proactive steps to avoid discrepancies in your tax return. When completing your tax return, you will encounter prompts asking for information regarding any state or local tax refunds you received. These are often complex, and if youre like many, this can be a frustrating process. If you itemized deductions on your federal return in the same year that you received the state or local refund, the refund may be considered taxable income. Knowing this is a critical piece to ensure that your tax return is filed correctly.

- Unveiling The Truth Did Kendall Toole Get Breast Implants

- Unveiling The Life Of Julie Jess A Comprehensive Insight

Here's a breakdown of what the "total payments and withholding" figure should include:

- Federal Income Tax Withheld from Wages: This is the largest component for most taxpayers. The amount is found on your W-2 form in Box 2.

- Estimated Tax Payments: If you're self-employed, a freelancer, or have income not subject to withholding, you likely make estimated tax payments quarterly. These payments are made using Form 1040-ES.

- Amounts Withheld from Pensions, Retirement Accounts, and Other Income: This covers any taxes withheld from sources beyond your regular employment income.

- Tax Credits: Certain tax credits can reduce your tax liability, such as the Earned Income Tax Credit or the Child Tax Credit. While not payments per se, understanding and claiming the credits you are entitled to can significantly impact your refund or the amount of tax you owe.

When you're on the "tell us about your refund" screen, you'll be asked to enter the total refund received. Additionally, you'll enter the amount in box 2 (state or local income tax refunds, credits, or offsets) of your 1099-G, if applicable. If you are missing a 1099-G, proactive measures are critical. You may need to contact the state or local government that issued the refund to request a copy. The state adjusted your tax refund (for some reason) and actually only sent you $570. It's also possible that they adjusted your refund, but ended up paying you interest on the amount so it was close to what you expected to receive. Be sure to carefully review your tax documents from last year to find the amount of last years state/local refund. Look for these in your state tax return. If you itemized deductions on your federal return and took a deduction for paying those taxes in a prior year and that deduction actually reduced your federal taxes, the refund may be considered taxable income.

The 1099-G form provides critical information. It reports any state or local tax refunds, credits, or offsets you received during the tax year. This is particularly relevant if you itemized deductions on your federal return in the previous year and deducted the state and local taxes you paid. In such cases, the refund you received may be considered taxable income. The main reason for the document is to provide these details to the IRS.

If you're filing your state income taxes online, you'll follow the specific instructions provided by your state's tax agency or the software you're using. Many tax preparation programs, like TurboTax, will prefill the amount of the refund you see on your 2023 Colorado individual income tax return form. You can also file your individual income tax return, submit documentation electronically, or apply for a PTC rebate. Dont forget to enter your total refund received in 2024 on the "tell us about your refund" screen. And if you require it, learn how to request corrected 1099s and where to submit them electronically or by paper. You can also find out how to check, reissue, or donate your Colorado tax refund. Don't forget about identity verification, validation keys, and intercepted refunds. Many tax professionals can help with frequently asked questions.

The presence of the 1099-G is crucial for accurate tax filing, it is very important to understand what it is for, when you need it, and where to find it. It is a common form and used for many reasons. You must understand all of the different aspects of the form.

It is imperative that you have all the necessary documentation before you file, this can save you time and headaches. Frequently, clients dont bring us the 1099-Gs for the state refunds, and we are held up waiting to get the EINs and addresses that would appear on the 1099-Gs. It's far better to proactively gather all the necessary paperwork, ensuring a smoother and more accurate tax filing experience. Here is a list of necessary information for all of the states 1099-G.

This information is often pre-filled, but it's always best to verify the details. Double-check that your name and Social Security number are correct, and that the amounts reported align with your records. If there are any discrepancies, it's crucial to address them promptly.

Let's turn our attention to a specific scenario: a state tax refund. Suppose you received a state or local tax refund in 2024. This is where things can get a bit more complex. These amounts typically only need to be reported if you itemized your deductions and you took a federal deduction for paying those taxes in a prior year and that deduction actually reduced your federal taxes.

Where can you find the amount of last years state/local refund? Well, the amount can be found in last year's state tax return. This is done with a line item on the state income tax return, and paid out together with the taxpayer's income tax refund (or credited to their income tax liability). However, the tabor refund is actually characterized as a refund of state sales tax. See for instance line 33 of the Colorado 2022 form DR 0104. Remember that the form 1099-G is an important document.

The IRS wants to make sure that you are very aware of the tax implications and the fact that if you got a refund, credit, or offset from a state or local government, that the 1099-G form is very important. This is because if you itemized deductions on your federal return, the state or local refund may be considered taxable income. Because of this, you must know the importance of the 1099-G form, and the implications of not having one.