Are you ready to embark on the journey of homeownership, but feeling lost in the maze of mortgage options? Understanding the nuances of mortgage prequalification and preapproval is the crucial first step towards securing your dream home.

Mortgage prequalification serves as your initial exploration into the world of home loans. It's a valuable tool for understanding your potential borrowing power and exploring various loan options. This preliminary assessment helps you get a sense of how much you might be able to borrow and what your monthly payments could look like. Think of it as a financial health check-up before you dive headfirst into the home-buying process.

Let's delve a little deeper, shall we? Mortgage prequalification is distinct from preapproval. While prequalification offers a general idea of your eligibility, preapproval takes it a step further. Preapproval involves a lender taking a more in-depth look at your financial situation, including your income, debts, and credit history. This results in a document a preapproval letter that specifies the amount the lender is tentatively willing to lend you. This letter holds significant weight, as it demonstrates to sellers that you are a serious, pre-approved buyer.

- Unveiling The Life Of Karen Davilas Exhusband

- Unveiling The Phenomenon Of Subhashree Saho Viral Videos

For a deeper dive into the world of home loans and the nuances of mortgage prequalification and preapproval, here is some valuable information, presented for easy access:

| Category | Details |

|---|---|

| Definition of Mortgage Prequalification | A preliminary assessment by a lender to estimate how much you might be able to borrow based on the information you provide about your income, assets, debts, and credit history. |

| Purpose of Prequalification | Helps you understand your potential home loan options, estimate your affordability, and get an idea of your monthly payments. |

| Definition of Mortgage Preapproval | A document from a lender stating their tentative willingness to lend a borrower a specific amount of money, based on a more thorough review of their financial situation. |

| Purpose of Preapproval | Provides a more concrete understanding of your borrowing capacity, and gives you a competitive edge when making offers on properties. |

| Key Differences | Prequalification is an informal estimate; preapproval is a more in-depth assessment and results in a formal letter. Prequalification is typically a faster process. |

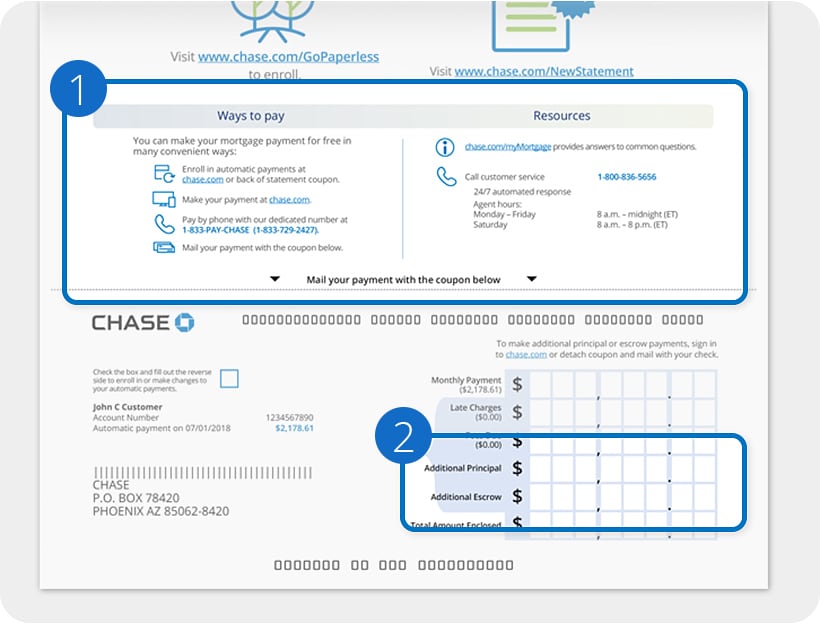

| Information Needed for Prequalification/Preapproval | Income verification (pay stubs, W-2s, tax returns), credit score, debt information (student loans, credit cards, etc.), asset information (bank statements, investment accounts). |

| Benefits of Preapproval | Provides a clear understanding of your budget, helps you shop with confidence, and can strengthen your offer when making a bid on a property. |

| How to Get Prequalified/Preapproved | Contact multiple lenders, both banks and mortgage companies, to compare rates and terms. Submit your financial information and documentation. |

| Timeframe | Prequalification is often completed quickly, sometimes in minutes. Preapproval can take several days or a couple of weeks, depending on the lender and the complexity of your financial situation. |

| Important Note | Preapproval is not a guarantee of a loan. The final approval is subject to property appraisal and a review of the borrower's financial situation at the time of closing. |

| Additional points | The prequalification helps you to decide what type of mortgage you'll likely qualify for by supplying information about your income, financial history and preferred mortgage terms. Mortgage preapproval could take up to 10 days, in part because of the process of submitting and reviewing financial paperwork. You could try to speed up the process by collecting all the paperwork |